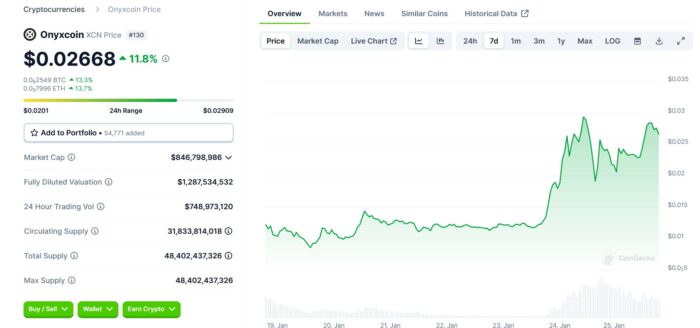

Onyxcoin (XCN) Skyrockets 800% in Two Weeks: What’s Behind the Hype?

3 min. read

Updated on

The price of Onyxcoin (XCN), the token powering J.P. Morgan-spinoff DeFi protocol Onyx, has been on an absolute tear. It’s up 149% in just 24 hours and a jaw-dropping 800% in the last two weeks, putting the spotlight back on a project that’s often overshadowed by giants like Aave and MakerDAO.

So, what’s driving this insane rally? A mix of major news, bullish sentiment across the crypto markets, and a dose of speculation. But, as with any explosive price move, there are risks to watch.

What’s Fueling the XCN Surge?

- HTX Global Partnership:

A long-standing feud between Onyx and crypto exchange HTX Global (formerly Huobi) has finally been resolved, thanks to governance proposal OIP-51. The deal gives HTX a say in Onyx’s governance and enables XCN staking on the exchange, bringing in $1.4 billion in trading volume in just 24 hours. This kind of liquidity injection has turned heads. - AI-Powered Innovation:

Onyx is rolling out Chain.ai, an AI tool designed to audit and optimize smart contracts. The hype around AI integration in crypto is massive, and XCN holders are getting exclusive early access to the tool. The project is pitching itself as a gateway to enterprise-level DeFi, which has stirred excitement among investors. - Regulatory Support:

The Trump administration’s Executive Order 14172, signed on January 20, is a win for DeFi protocols like Onyx. It streamlines compliance processes, easing concerns about regulatory hurdles, especially for projects with institutional ties like Onyx.

Where’s XCN Heading Next?

Right now, XCN is riding a wave of momentum, but the charts tell a mixed story:

- Bullish Targets: The token recently broke out of a long-term cup-and-handle pattern, and analysts think it could hit $0.08–$0.10 if buying pressure continues.

- Warning Signs: At the same time, XCN’s Relative Strength Index (RSI) is sitting at a sky-high 89, which usually signals overbought conditions. Historically, this kind of setup often leads to price pullbacks.

Risks to Watch

- Supply Pressure: Only 9% of XCN’s total supply is staked or locked, leaving a whopping 43.8 billion tokens in circulation. If traders start cashing out, that could weigh heavily on the price.

- Leverage Overload: Futures trading for XCN is booming, with open interest up 270% to $73.9 million. Many traders are using 25x leverage, meaning even a 10% price dip could spark massive liquidations.

- Hype vs. Reality: While Chain.ai and regulatory clarity are exciting, some of the price action is likely driven by speculation rather than long-term fundamentals.

Should You Buy XCN?

XCN has potential, especially with its enterprise ties and AI-driven ambitions, but it’s not without risks. For investors eyeing a piece of the action, here are some things to keep an eye on:

- Can XCN hold above $0.03 to confirm bullish momentum?

- How will Chain.ai be adopted after launch?

- Will regulatory clarity actually boost confidence in DeFi projects with big institutional connections?

Onyxcoin’s rally has been explosive, driven by big partnerships, tech innovation, and broader market optimism. However, with high volatility (30-day historical volatility is at 33.49%) and reliance on leveraged trading, the token’s upward trajectory comes with risks.

If the macro crypto environment stays bullish, XCN hitting $0.10 isn’t out of the question. But for now, it’s a classic example of the fine line between a compelling narrative and actual fundamentals. Trade carefully.

User forum

0 messages