Whales Shorting Ethereum Create Havoc Among Investors Bringing Fear

2 min. read

Published on

Ethereum (ETH) recently saw a sharp price drop, falling over 25% to as low as $2,120 before having a modest recovery. This drop was partly caused by big investors, known as “whales,” who make major moves in the market, thus influencing it.

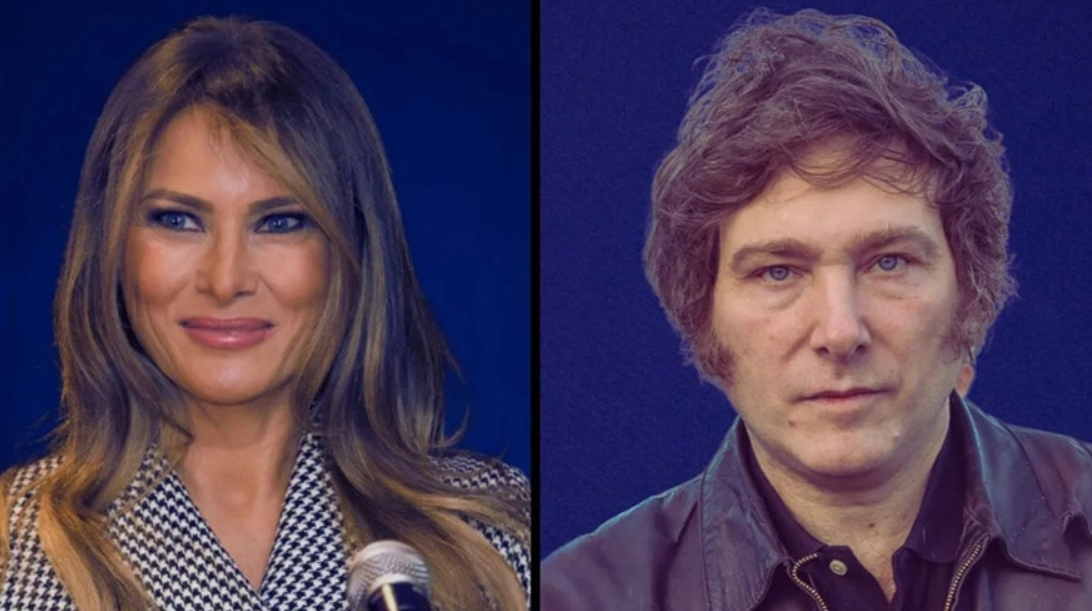

One of them made a huge profit by betting against ETH. Using 50x leverage, they shorted ETH. As it price dropped to around $3,050, their unrealized profit reached over $16.8 million. This shows how big traders can take advantage of market dips.

Another whale, who had been inactive for six years, suddenly moved 77,736 ETH to the Bitfinex exchange (worth about $228.6 million). When large amounts of crypto are sent to exchanges, it usually means the owner is planning to sell. This added more pressure on ETH’s price.

Big investors like this have a history of shaking up the crypto market. In 2020, a single Bitcoin whale caused a major price drop after moving a large amount of BTC to an exchange. In 2021, Ethereum whales selling off their holdings led to a quick price dip. These moves show how just a few big traders can influence prices.

The recent ETH drop also happened at the same time as global economic changes. New U.S. trade tariffs have caused uncertainty in financial markets, which can impact crypto prices as well. Investors are watching closely to see how this affects ETH and other cryptocurrencies.

User forum

0 messages