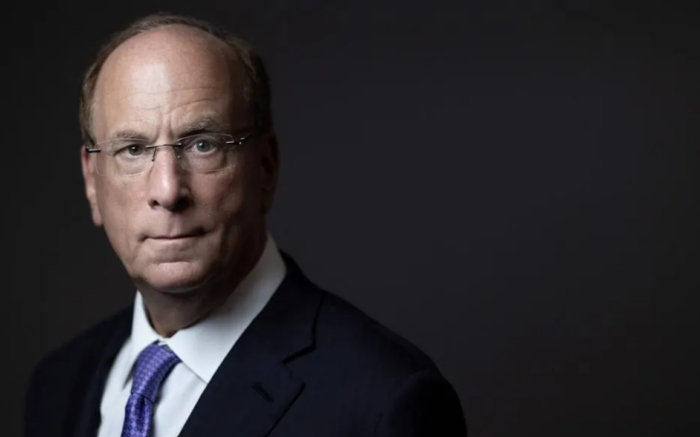

Bitcoin at 700000$: Larry Fink creates buzz around ETFs

2 min. read

Updated on

In a recent discussion at the World Economic Forum in Davos, Larry Fink, CEO of BlackRock, suggested that Bitcoin’s price could soar to $700,000 if institutional investors, such as sovereign wealth funds, allocate a portion of their portfolios to the cryptocurrency, specifically 2% and 5%.

Fink, who previously expressed skepticism about digital assets, now views Bitcoin as a “currency of fear” as a hedge against currency devaluation and economic instability, thus giving the green light to the altcoin market growth to a new ATH.

This shift in perspective aligns with BlackRock’s strategic moves in the cryptocurrency market. In January 2024, the firm launched the iShares Bitcoin Trust (IBIT) , its first spot Bitcoin exchange-traded fund (ETF), providing investors with regulated exposure to Bitcoin.

The ETF experienced unprecedented success, amassing over $50 billion in assets within 11 months, marking the most successful ETF debut in history.

Fink’s optimistic projections and BlackRock’s active participation in the Bitcoin market have coincided with significant price movements. Following the launch of IBIT, Bitcoin’s price surged, reaching an all-time high of over $100,000 in December 2024.

Analysts suggest that endorsements from influential financial figures and the introduction of accessible investment vehicles like ETFs can bolster investor confidence, potentially driving demand and influencing market dynamics.

While Fink’s comments are not direct investment advice, his recognition of Bitcoin’s potential and BlackRock’s initiatives in the crypto space and the endorsement of tokenization of bonds and stocks may encourage investors to consider Bitcoin as part of their portfolios. This increased interest could contribute to upward pressure on Bitcoin’s price, illustrating the impact that institutional perspectives and products can have on the cryptocurrency market.

User forum

0 messages